This knowledge will change your entire life, the same way it changed mine.

I started investing at the end of 2019. I vividly remember going into my bank and asking to open a self-directed investing account, only to be told by my bank teller, “you’re too young for that. Even I don’t direct my own investments. Let’s start with a savings account.”

I’ll never forget that moment. You’ll find on your wealth journey, many people will project their limiting beliefs onto you.

I’ve learned that banks overcharge like crazy for self-directed investments (starting at $5 per buy and sell of X stock) – do not invest with a bank! To invest in options, which I’m about to share with you, you’ll need to open an account with a brokerage that allows you to trade more forms of investments and markets. I use Interactive Brokers.

Open your investing accounts using my link and get a stock worth $1000 for free.

What is an options contract?

A stock option contract is 100 shares of the underlying stock.

An options contract is an agreement between two parties to facilitate a potential transaction involving an asset at a preset price and date. Call options can be purchased as a leveraged bet on the appreciation of an asset, while put options are purchased to profit from price declines.

Investopedia

From October 2019 to October 2020, I only invested in stocks and ETFs.

In November 2020, I invested in my first call options contract.

I’ve never invested in a single individual stock or ETF ever since. When you trade options, the math is different. Exponentially different.

Since November 2020, I’ve 9X’d my initial investment in less than 2 years, and I’ve spent my time teaching my family and friends how to do this for themselves.

My incredible boyfriend Joshua taught me how to invest in call and put options in September 2020. He learned from Seattle-based investors and co-founders Mark & Jolyn from The Come Up Series, an investment school whose mission is to close the racial wealth gap within one generation.

Mark & Jolyn create these videos at no cost. All they ask in return for teaching this knowledge is to share this life-changing information.

The Come Up Series

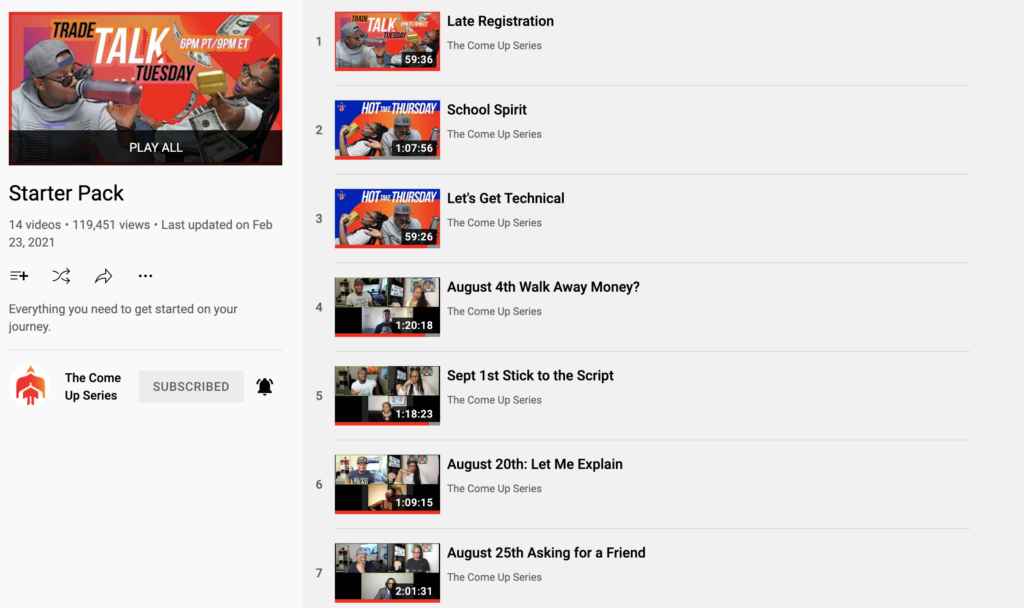

When you start your journey to options trading with The Come Up Series, start with the Starter Pack playlist. Each episode is approximately 1 hour long, and it is a class, so make sure to be ready and take lots of notes! You’ll be studying the course material for a long time.

If you’re a complete beginner to the stock market, I recommend learning some basic stock market fundamentals. The Starter Pack assumes that you already understand some terminology, such as technical and fundamental analysis.

I’m so excited to be sharing this with you! Mark states multiple times that the average return on investment is 500% per contract, and I can tell you from experience, that you can make way more. Having this kind of ROI makes you realize how a 7% average annual return on the S&P is nothing, better yet the average 0.5% interest rate on savings accounts.

Happy investing! I hope this deeply impacts the trajectory of your wealth journey, and what you believe is possible in such a short amount of time.

If there’s anything I’ve learned over the past 2 years, I’ve learned that I’ve been thinking too small, and it’s time to think even bigger.

If The Come Up Series has changed your life the same way it changed mine & my loved ones, please share their videos with yours.

Let’s close this racial wealth gap in one generation.

Love,

Leave a Reply