As a Canadian personal and business finance enthusiast, I’ve done hours of research learning about the best financial products and services that I’ve personally used and recommend over the past 3 years. Enjoy!

Goals, Spending Trends, & Forecasting: Mint

The free all-in-one place to track every single account you own. Track your net worth, loans, debt, savings, investments, properties, and more on here. Mint isn’t perfect, and I still have to manually once a week input the correct categories of expenses, but I love the ease and simplicity of the platform.

- Forecasting and planning

- Credit monitoring

- Tracking your spending

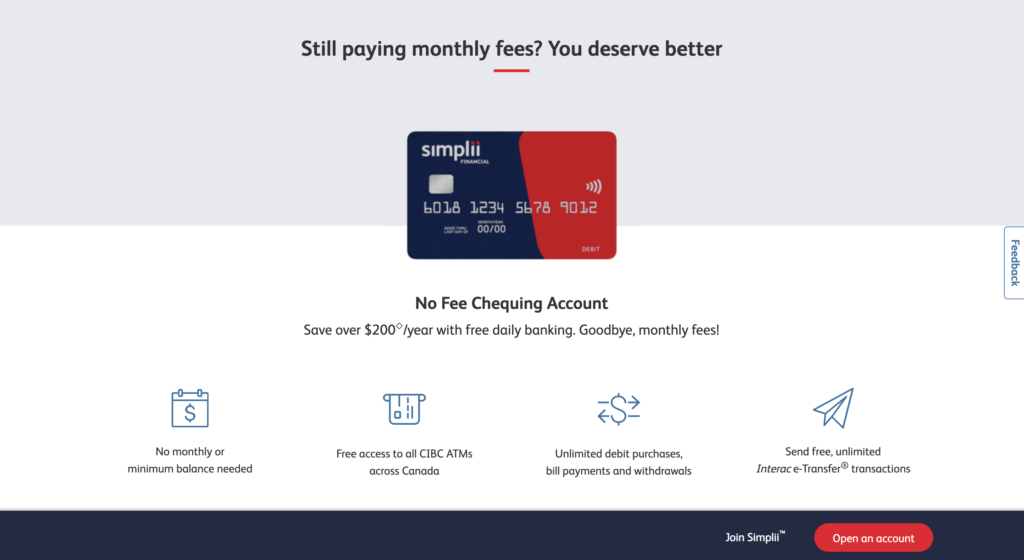

Checking: Simplii Financial No Fee Checking Account

Simplii Financial is CIBC’s cool online-savvy younger sibling. You have all the benefits of being a CIBC member without the monthly fees because this bank is digital. You still have access to CIBC’s ATMs.

- No monthly or minimum balance needed

- Free access to all CIBC ATMs across Canada

- Unlimited debit purchases, bill payments, and withdrawals

- Send free, unlimited Interac e-Transfer® transactions

Use my link and earn $50 when you open and use an eligible account with Simplii™.

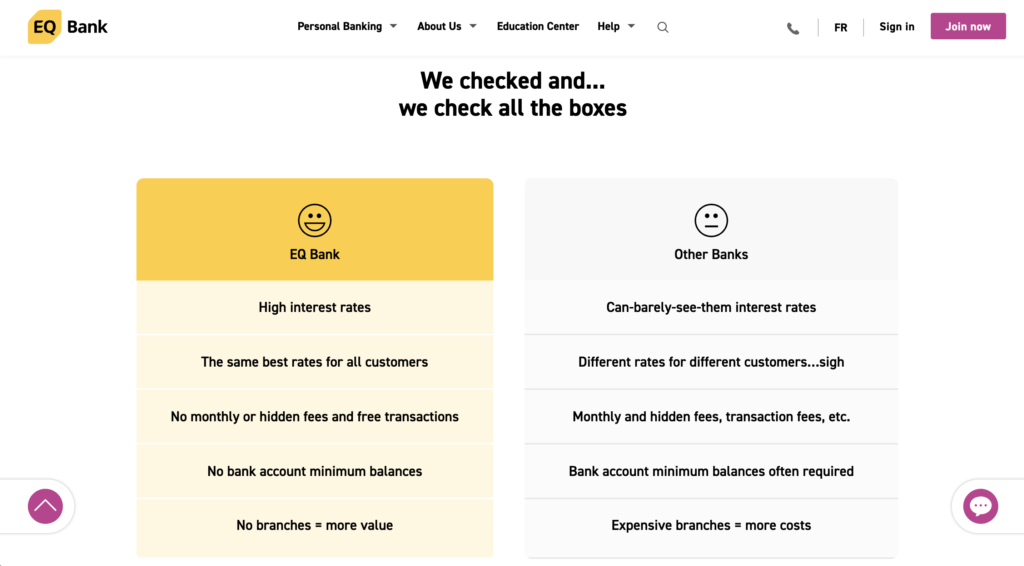

Savings: EQ Bank Savings Plus Account

This is where I keep my emergency fund. Your emergency savings should consist of 1 to 6 months of savings depending on your expenses. EQ Bank has the highest interest savings account on the Canadian market.

- 1.25% interest

- No monthly fees or minimum balance

- Free bill payments

- Free Interac e-Transfers

Get $20 when you deposit $100 to your new EQ Bank account with my referral link.

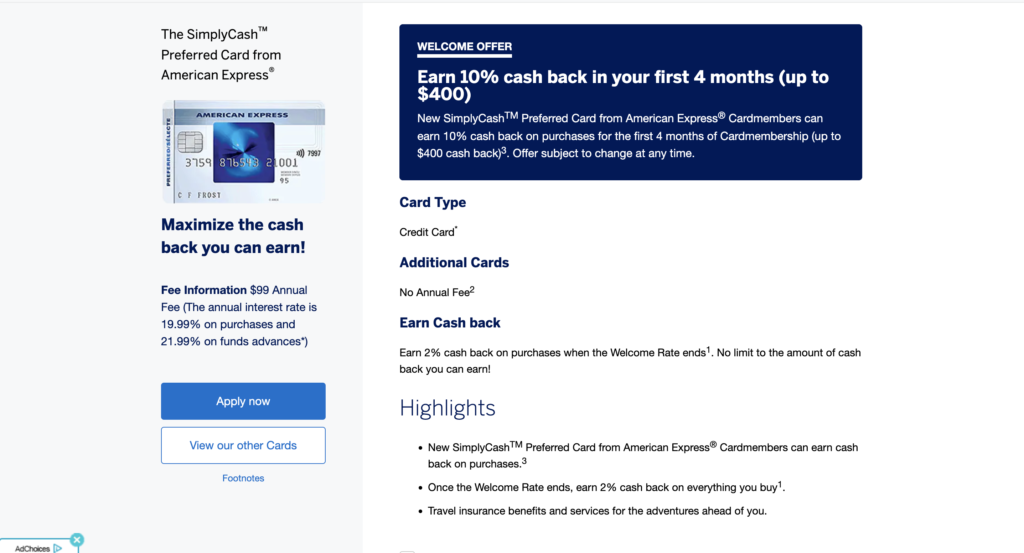

Credit Card: AMEX Simply Cash Credit Card

This is my favourite credit card. Not only does it look so unique and reflective in person, but the 2% cashback on all your purchases is amazing. AMEX always offers incredible travel and entertainment deals, like first pick Ticketmaster seats to your favourite artist. The only downside is that AMEX isn’t accepted by all businesses, especially small businesses in Canada.

- Earn 2% cashback on everything you buy!

- Travel insurance benefits and services

- $99 annual fee

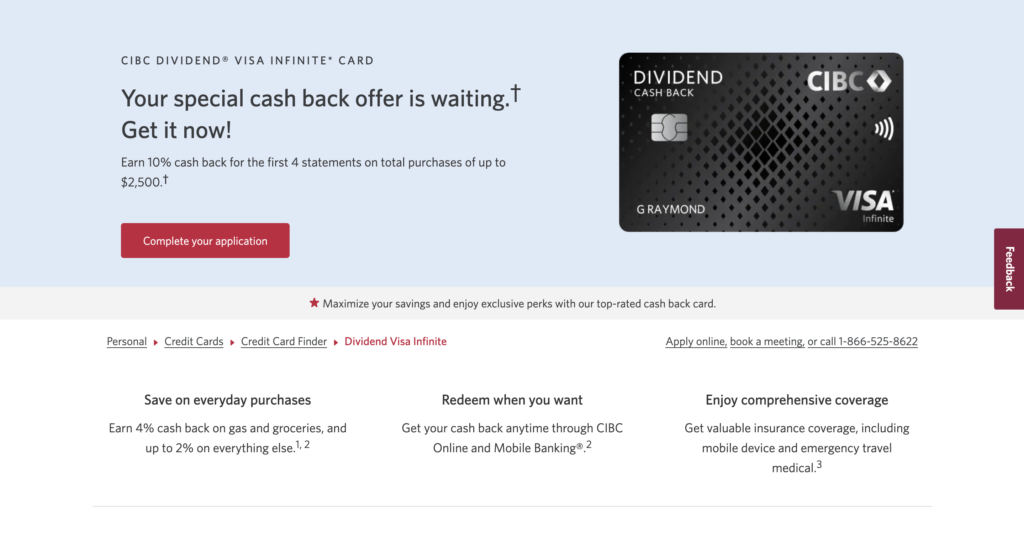

Credit Card: CIBC Dividend Visa Infinite Card

When my AMEX isn’t accepted, I pull out this card, especially for grocery shopping. If you drive a gas car, CIBC has a partnership with Chevron that lets you save 10 cents per liter.

- 4% cashback on gas and groceries

- 2% on transportation, dining, and recurring payments.

- 1% cash back on everything else

- Get valuable insurance coverage, including mobile device and emergency travel medical

- $120 annual fee

Learn more about the CIBC Dividend Visa Infinite Card

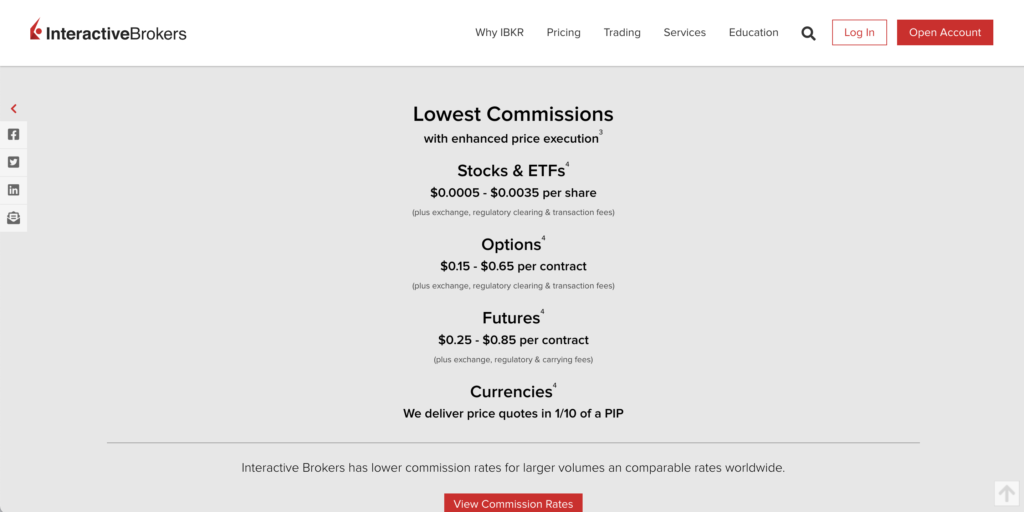

Investing: Interactive Brokers for RRSP, TFSA & Individual Accounts

Interactive Brokers has completely leveled up my investing experience. In addition to having access to all advanced trading features, such as futures, options, 3X leveraged ETFs, and fractional shares (to name a few), commissions are extremely low. If you’re a more experienced and advanced investor, IBKR is perfect for you. Traditional bank brokerages charge up to $5 to $10 PER trade. Insane.

- Low commissions starting at $0 with no added spreads, ticket charges, platform fees, or account minimums.

- Financing rates up to 50% lower than the industry

Open your investing accounts using my link and get a stock worth $1000 for free.

Business Checking & Credit: RBC Digital Choice Business Account

If you own a business that doesn’t need frequent physical cheque deposits, this digital account is all you need. I always recommend this account for all business owners. RBC’s business credit card always has new promotions and deals to claim on small businesses as well.

- $5 monthly fee

- Link your eligible RBC business cards to your Petro-Canada card and instantly save 3¢/L on gas at Petro-Canada locations

- Unlimited Electronic debit and credit transactions

- Unlimited Mobile & ATM cheque deposits

- Send free 10 Interac e-Transfers. $1.50 per transfer thereafter

Learn more about the RBC Digital Choice Business Account

I’m always on the lookout for amazing financial services. If you have any recommendations, I’d love to hear from you! Leave a comment below and let me know.

Leave a Reply